Irs Schedule K 1 2024

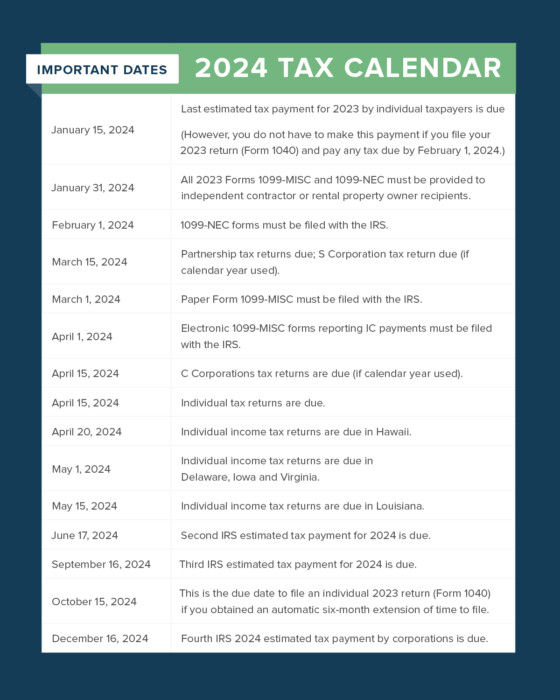

Irs Schedule K-1 2024 – The Internal Revenue Service released its annual inflation adjustments Thursday for the 2024 tax year that will boost paychecks and lower income tax for many Americans. . If you are looking to get on track to becoming a 401(k) millionaire or achieving financial freedom, the IRS has just announced the new 2024 401(k) contribution limits. For those with a 401(k), 403 .

Irs Schedule K-1 2024

Source : www.irs.gov

FACTS Flyer 2023 2024 Padua Franciscan High School

Source : paduafranciscan.com

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

Business tax deadlines 2024: Corporations and LLCs | Carta

Source : carta.com

Property Management Tax Reporting Made Easy | Buildium

Source : www.buildium.com

Yasser Martinez (@yassermr) / X

Source : twitter.com

IRS releases new IRA, 401(k) contribution limits for 2024 al.com

Source : www.al.com

3.0.101 Schedule K 1 Processing | Internal Revenue Service

Source : www.irs.gov

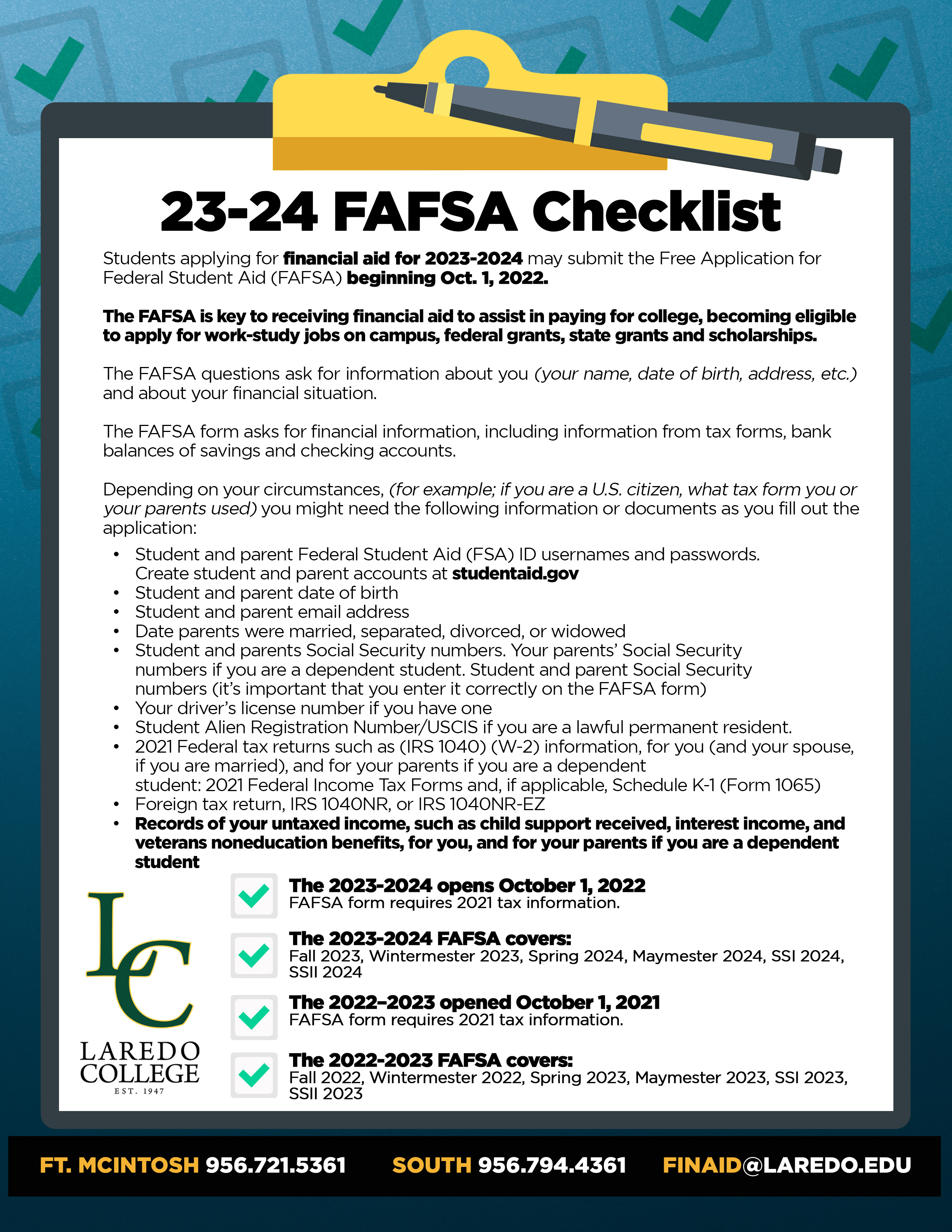

Laredo College on X: “Need further guidance on how to complete

Source : twitter.com

3.30.123 Processing Timeliness: Cycles, Criteria and Critical

Source : www.irs.gov

Irs Schedule K-1 2024 3.0.101 Schedule K 1 Processing | Internal Revenue Service: The Internal Revenue Service announced Wednesday that the amount individuals can contribute to their 401(k) plans in 2024 has increased to $23,000, up from $22,500 for 2023. The IRS also issued . Schedule K-1 recipients If you’re someone who is a partner or an S Don’t miss out during the 2024 tax season. Register for a NerdWallet account to gain access to a tax product powered by Column .